Negative Sentiment Deepens In Crypto, Why Recovery May Not Last

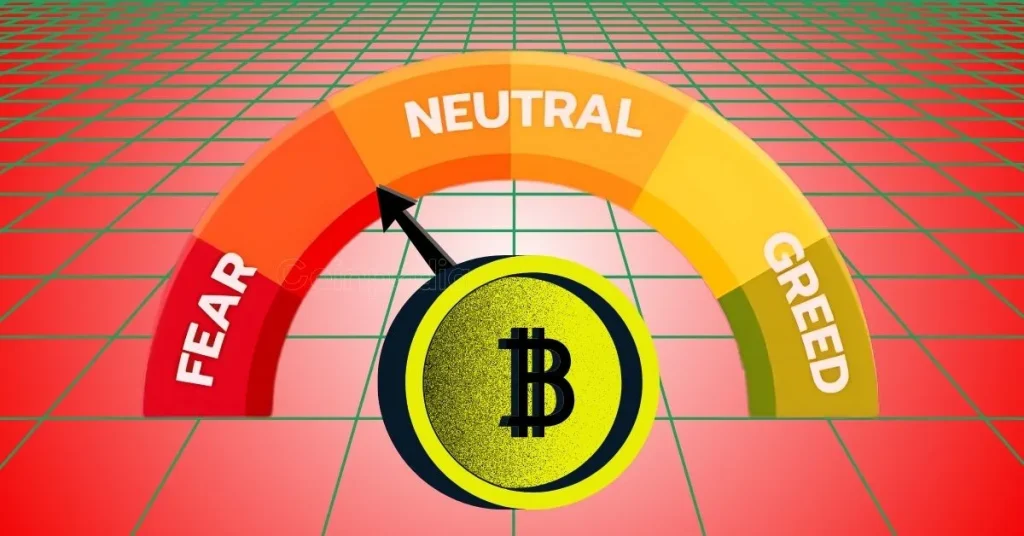

Negative sentiment in the crypto market has been ramping up in the last few months. This comes hot on the heels of a market crash that saw top coins such as Bitcoin and Ethereum drop to one-year lows. It has resulted in some of the lowest scale readings that the Fear & Greed Index has put out in recent times and it looks like this is only just beginning as negative sentiment has now touched yearly lows. Crypto Market In Extreme Fear Just like with any declining market, investor sentiment has turned to the worse. Indicators show that the market is now in extreme fear, meaning that investors are wary of playing in the space. This has been the case for a while but the recent readings provided by the Crypto Fear & Greed Index show that it is worse than expected. The index currently displays a score of 10 which is one of the lowest levels that it has been in the last six months. The last time the index was this low was in January when the market was still reeling from the December 4th crash. What followed was a prolonged period of downtrends, similar to what is being experienced in the market for the last few weeks. Related Reading | Perp Traders Remain Quiet As Bitcoin Struggles To Hold $30,000 This negative sentiment continues to wax stronger even through recoveries. Currently, the price of bitcoin is back above $30,000 and Ethereum continues to push for $2,000 but that has not triggered any change in investor sentim...