TA: Ethereum Rejects $4K: Why It Is Vulnerable To Below $3.9k

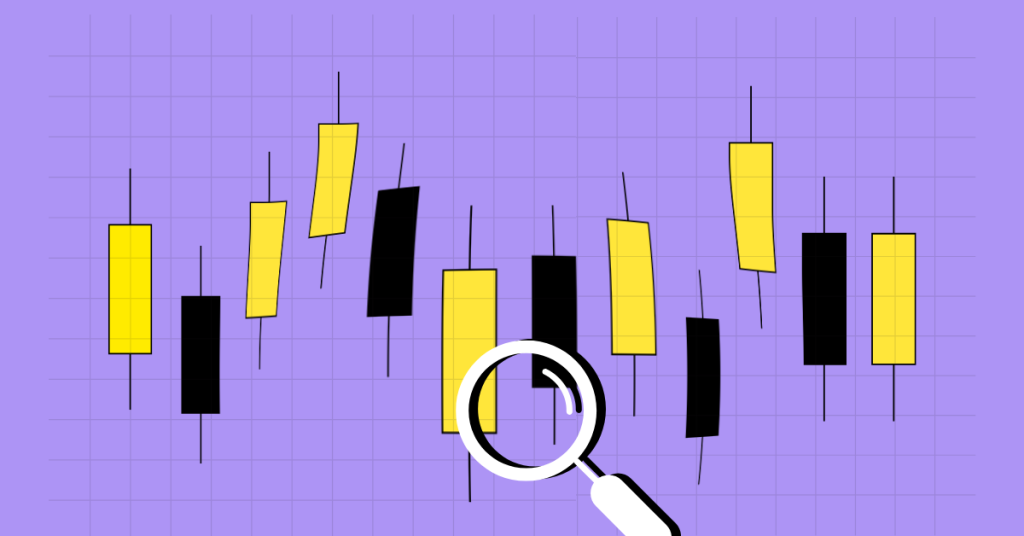

Ethereum failed to settle above the $4,000 zone against the US Dollar. ETH price is correcting gains and it could dive if there is a break below $3,900. Ethereum struggled to clear the $4,050 resistance zone and declined. The price is trading below $4,020 and the 100 hourly simple moving average. There is a key contracting triangle forming with resistance near $3,980 on the hourly chart of ETH/USD (data feed via Kraken). The pair must stay above $3,900 to start a fresh increase in the near term. Ethereum Price Corrects Lower Ethereum made an attempt to gain strength above the $4,020 and $4,050 resistance levels. ETH even climbed above the $4,050 level and the 100 hourly simple moving average. However, there was no upside continuation above $4,075. A high was formed near $4,075 and the price started a downside correction. There was a break below the $4,000 support level. Ether even declined below the 23.6% Fib retracement level of the upward move from the $3,750 swing low to $4,075 high. It is now trading below $4,020 and the 100 hourly simple moving average. An immediate resistance on the upside is near the $3,980 level. There is also a key contracting triangle forming with resistance near $3,980 on the hourly chart of ETH/USD. Source: ETHUSD on TradingView.com The next major resistance is near the $4,020 level. A clear upside break above the $4,020 level could push the price further higher in the near term. The next stop for ...