GRT Technical Analysis: Trend Traps Buyers As $0.30 Weakens

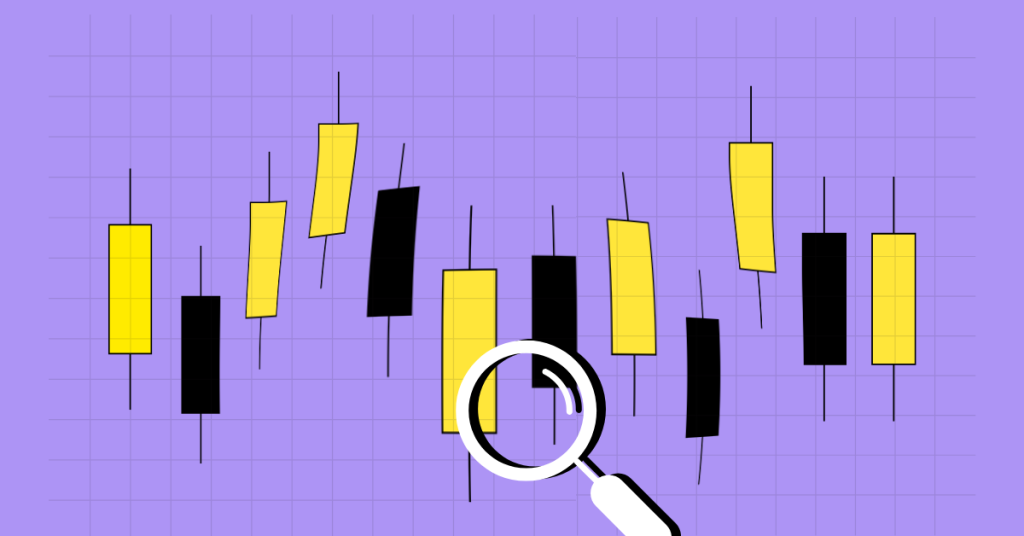

GRT prices show a higher price rejection in the daily candle, projecting a rise in the underlying selling pressure. Will sellers retake the $0.30 support level? Key technical points: GRT prices show a sideways trend above the $0.30 mark. The MACD indicator shows a bearish trend continuation below the zero line. The 24-hour trading volume of Graph is $136 Million, marking a 5.5% rise. Past Performance of GRT GRT prices show a consolidation range above the $0.30 support level after facing rejection at the 50-day EMA. However, looking at the broader picture, the bearish started after facing rejection at the descending resistance trendline resulting in the formation of a falling channel. Source-Tradingview GRT Technical Analysis The higher price rejection evident in the daily candle projects a much more likelihood of a bearish continuation in GRT prices below the $0.30 support level. Hence, traders can find a selling opportunity shortly. The crucial daily EMAs maintain a falling trend in a bearish alignment with increasing spread among the lines. Moreover, the price falling under all the EMAs reshape the lines as resistance levels. The RSI slope shows a sideways trend in the nearly oversold territory under the 14-day average line influence. Hence, the bearish impact on the RSI slope is evident and reflects a potential fall to the oversold zone. The MACD and signal lines are gaining a bearish spread after diverging from the recent ...