XMR Technical Analysis: The First Signs Of Buyers’ Rebellion

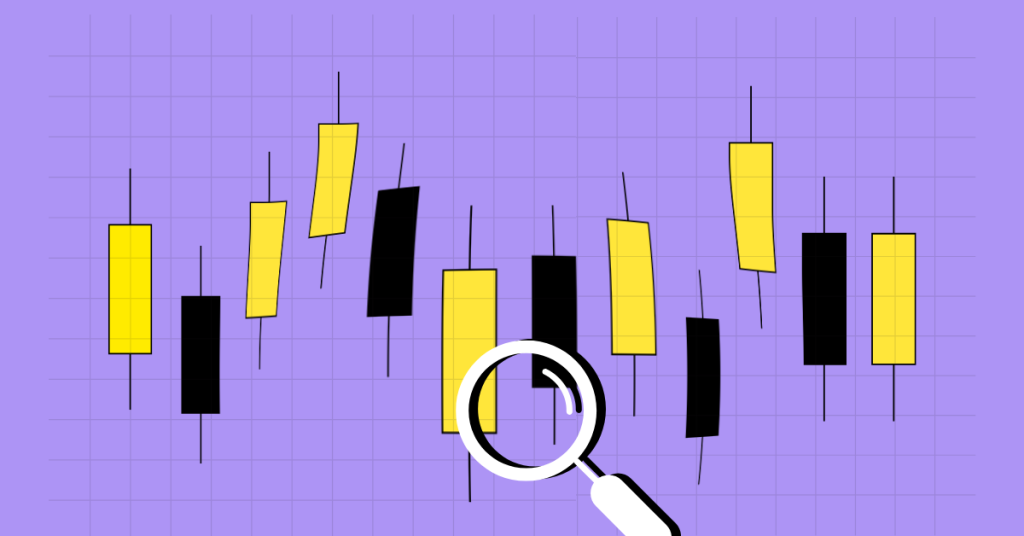

If it is old, it does not mean that it is not relevant. These words were clearly confirmed by the XMR cryptocurrency during the trading week of 7 March. While most cryptocurrencies are consolidating in narrow ranges, XMR has organized a price shot by 70% for the week. Sellers managed to take the situation under temporary control and kept the critical range of $180. However, after the closing of the weekly candle on 7 March, we will not see an active counterattack by sellers, as is the case after a powerful false break in the big timeframe. Instead, we see a new attempt by buyers to squeeze in and take control of the $180 mark. https://www.tradingview.com/x/BIkSIQJe/ The XMR price growth stop at around $283 clearly showed where the main resistance from sellers is. Given the dynamics of the cryptocurrency market, the high probability of USDT dominance fall, and the anonymity of the XMR cryptocurrency – the probability of re-testing the mark of $283 is the highest. However, for such a positive scenario, buyers need to take control of the $180 mark during the week of 14 March. Closing the current weekly candle below this mark will indicate the weakness of buyers and the beginning of the XMR price fall to $145 to begin with. Technical Analysis Of XMR On The Daily Timeframe https://www.tradingview.com/x/duFsQ92y/ And now we would like to look in detail at the breakdown of the $180 range in the daily timeframe. Note that the increase...