FTM Technical Analysis: Psychological Barrier Brings 10% Reversal

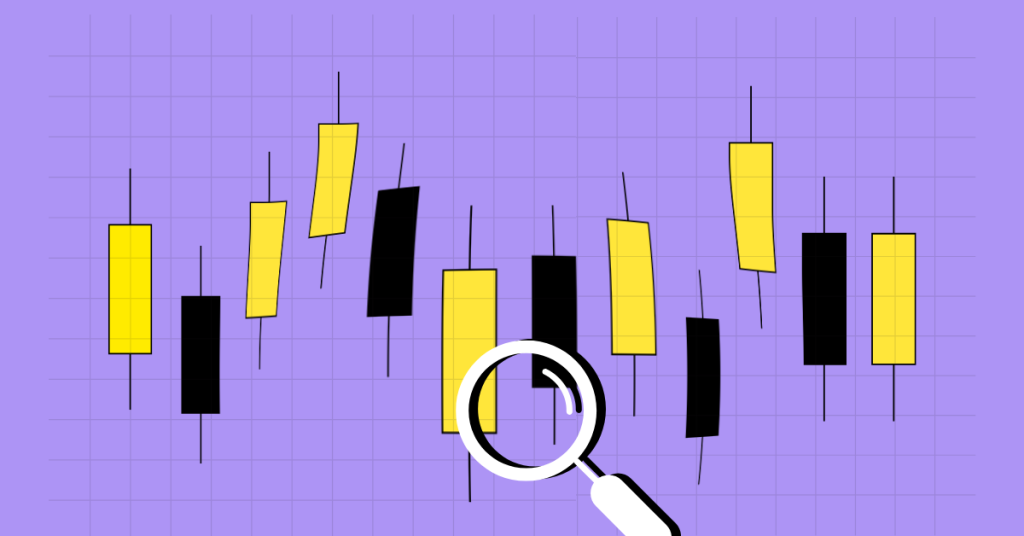

FTM coin price shows a post-retest reversal from the 200-day EMA resulting in a freefall of more than 10% overnight. Will this reversal reach $1.20? Key technical points: The 50 and 100-day EMA give a bearish crossover The RSI slope struggles at the 14-day average The 24-hour trading volume in the Fantom token is $1.09 Billion, indicating a 5% rise. Past Performance of FTM The lower price rejection from $1.20 promoted the underlying bullish trend momentum growth, resulting in an engulfing candlestick as a follow-through. The short but sharp recovery of 17% in FTM prices surpassed the 200-day EMA but failed to close above it. Leading to a higher price rejection, the rejection drove the prices down by 10% within a day. Source-Tradingview FTM Technical Analysis The FTM coin price action forms an evening star pattern representing the reversal from 200-day EMA. Hence, the increased bearish momentum indicates a downfall to the $1.2 mark if the prices give closing below the $1.5 mark. Downfall in the Fantom coin price brings the crucial EMAs- 50 and 100 giving a bearish crossover. Moreover, the psychological barrier of the 200-day EMA brings the bearish reversal and increases selling pressure. The DMI indicator shows a massive gap between the DI lines with a negative formation indicating a definite bearish trend. Additionally, the rising ADX line suggests a boom in trend momentum. Hence, a downfall to the $1.20 is plausible. The RSI ...